Implementation of an MCA software is one of the basic necessities to smoothly run an MCA business. The software must be flexible, integrated, easy to use, and reliable to optimize operations and perform with minimum procedural frictions. So what is the best MCA software in 2022 for your business?

The MCA market (in regards to MCA software) is dominated by two major companies providing customer relationship management and integration MCA software.

These companies are LendSaaS and MCA suite. Let’s go through the comparative analysis in terms of features to decide a better option for your MCA businesses.

Essential Features For An MCA Software In 2022

In an industry that changes as rapidly as the MCA world, it’s unsurprising that brokers, ISOs and MCA business owners have more automation options than ever before.

Here are the most important facets to consider when deciding which MCA software to work with in 2022.

1- Scalability

Scalability refers to the ability of the software to accommodate the growing demand of your business.

For example, there may be a need to enhance the scale of integration with the growth of clients and demand of the business. So, your MCA must be able to handle exponential growth, even if it is unexpected.

LendSaaS has the greater ability to get integrated with third-party software.

LendSaaS can be linked with Experian, clear, ACH, Money thumb, dataMerch, and Decision logic and many more. These integrations can effectively extract data from these companies and use it in the process to decide the status of the specific loan application.

In fact, quick scalability is a unique feature of the Lendsaas. On the other hand, the MCAsuite also provides API integration. However, it’s limited. So, from a scalability perspective, Lendsaas is preferable.

2. Reporting And Analytics

Comprehensive and reliable facts reporting is one of the most important features of MCA software. It enables you to analyze your portfolio, track performance, improve business efficiency, and make decisions related to changes in the business.

MCA software provides different reports and dashboards to ease users in tracking performance and making a decision.

LendSaaS software provides a comprehensive dashboard and multiple reports regarding performance quality control, stats, insights, portfolio, default repayment rate, syndication, and deals, etc.

MCA suite also provides such reporting mechanics. However, functions and features are far less detailed than LendSaaS.

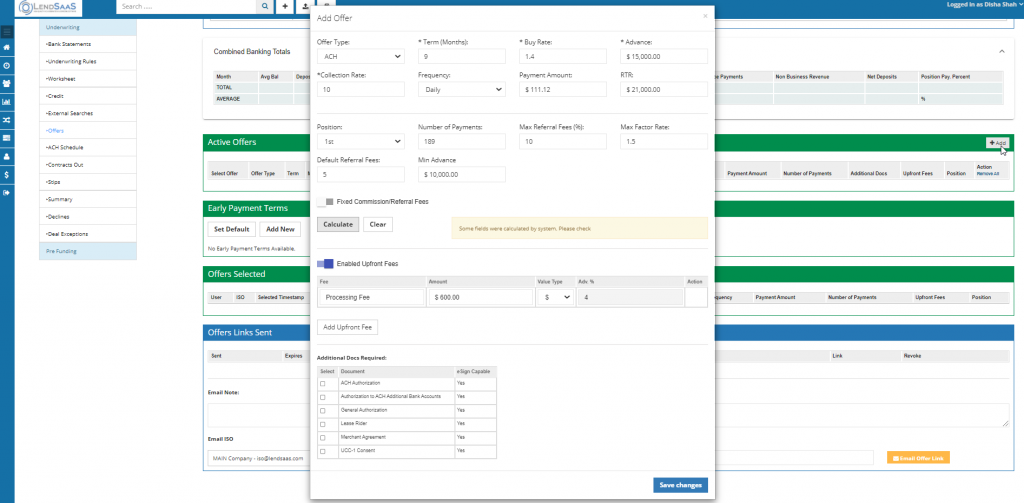

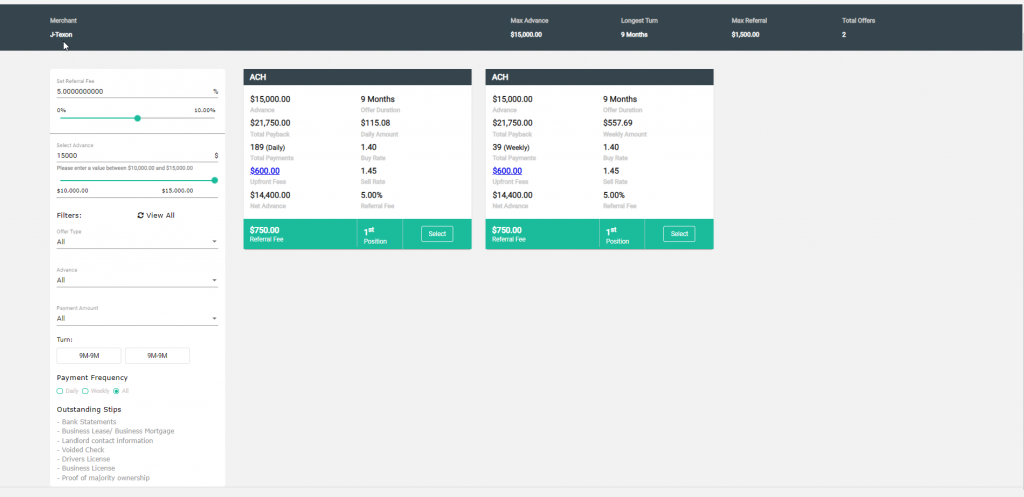

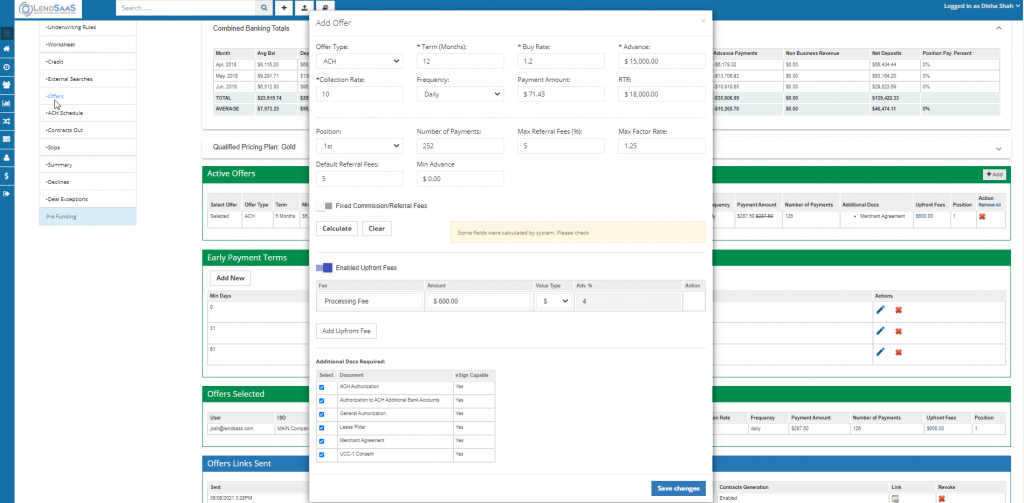

3. Deal Tracking

MCA deal tracking refers to the ability of software to track a deal from lead generation underwriting, disbursement, and collection of funds from borrowers. It’s about being able to exercise control over the entire business process of MCA.

Further, the tracking function can be effectively utilized at time of refinancing request.

LendSaaS provides a more detailed and easier to use deal tracking module. This separate module is for more than the refinancing facility and underwriting. So, from the perspective of deal tracking, it is clear that LendSaaS outshine MCA Suite.

4. Element Of Ease

Element of ease refers to overall user experience with the software. It’s mostly about following,

- Is that easy to understand working mechanics of the software?

- Is that easy to track the performance of the business?

- Is that easy to learn and apply features of the software?

- Is it effective to use software from a business perspective?

- Is that time-efficient to use the software?

From the perspective of given factors, Lendsaas seems to be more user-friendly in terms of operational use and ability of users to learn features because of simple interface.

5. Bank Statement Parsing

For MCA businesses, it’s important to investigate data provided by the prospective borrower. The reason is that financing approval is a key decision to assess if funds will be collected back from the borrower. In fact, it’s the biggest risk of the MCA that funding can be made to someone with corrupt financial background.

To help with this challenge, Lendsaas offers bank statement parsing that helps to enhance reliability of the input in the underwriting process. Hence, it can be a value-adding feature for the MCA.

6. Customer Support Services

LendSaaS offers excellent customer support services. Their team is more capable and professionally competent to offer quick solutions than any other MCA software company in the market.

No other MCA software will be providing better customer support than LendSaaS in 2022.

So, What Is The Best MCA Platform In 2022?

Based on the operational aspects for MCA business, the features offered by LendSaaS are more effective in tracking and managing an MCA business.

The fact alone that it offers exceptional scalability with higher integration puts it above MCA Suite.

Easy-to-use features, comprehensive reporting for performance measurement, bank statement parsing, and customer support services, LendSaaS is the obvious choice.

Conclusion

Effective implementation of software helps MCA businesses to effectively manage business operations. It’s about taking care of the business from lead generation to borrowing approval and collection of funds.

The software can help extract information by using third-party APIs. Further, the reliability of such data can be tested with the API of different companies. In addition to this, different features need to be considered before implementing software.

These features include scalability, reporting & analytics, deal tracking, element of ease, bank statement parsing, and customer support services.

There are two main players in the MCA market: Lendsaas and MCA suite.

Both of these MCA softwares offer features to effectively manage operations. However, Lendsaas has some operational advantages in terms of better integration and ease of use. Making LendSaaS the better MCA software in 2022.

Frequently asked questions

What are the most critical factors of managing MCA business?

Underwriting and funds collection are the two most important aspects of the MCA business. Underwriting is about approving the loans by extracting and assessing the accuracy of the input data. On the other hand, funds collection can be challenging and complex.

What are the most important advantages of implementing software in the MCA business?

The following three are the most important advantages of implementing software in the MCA business.

- Automated underwriting – it’s about extracting data from different companies, assessing its reliability and making a quick decision for a specific loan application.

- ACH collection can be a convenient, flexible, and fast to collect payments from borrowers.

- Detailed reporting – Software can provide structured insights to help in the decision-making process.

Why is an integration of the underwriting system important?

Integration of the underwriting system is important because of the following two reasons.

- Extraction of records from third-party companies to check the background details of prospective borrowers.

- To assess the accuracy of the input data submitted by the prospective borrower.

Leave a Reply