Strategic capability is always derived through professional coordination and the right business association. Significant success in any field is never possible without understanding technical dynamics and operating norms. In the MCA world, your business needs an MCA platform in 2022.

To continuously fuel exponential growth and quickly adopt strategic changes, MCA business needs affiliation with the right MCA platform. Here are key benefits of such affiliations.

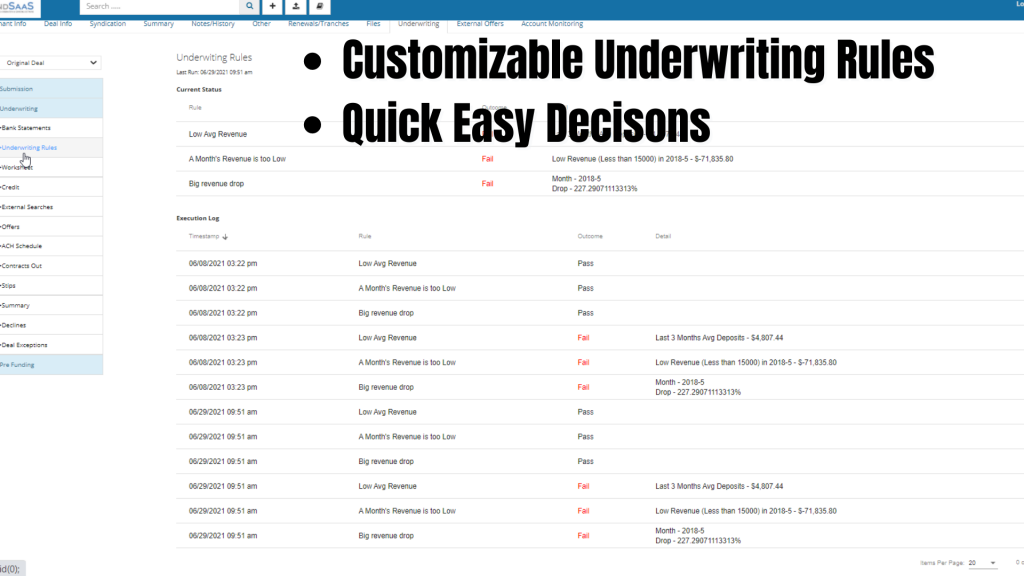

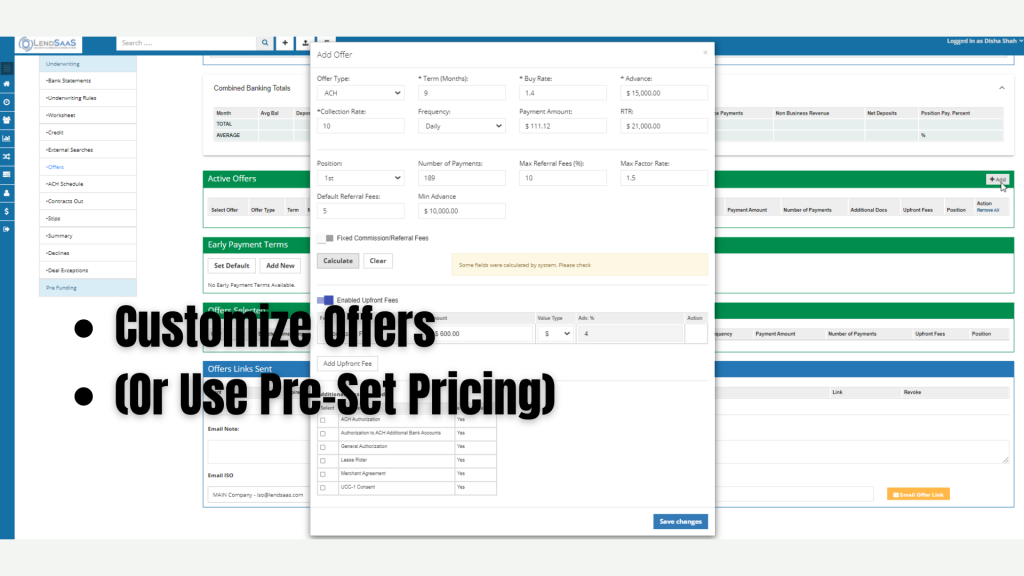

1. Automated Underwriting

Automated underwriting refers to the tech-based process of loan approval. An artificial decision-making system is provided with an algorithm to consider different relevant factors while deciding if specific request for the loan should be approved.

LendSaaS is efficient and quick in making decisions about specific loan requests. Hence, significant help can be expected in the overall process to approve a loan with platform association.

It’s equally important to note that the system only displays final decisions if it’s sure about them; otherwise, an application is flagged for a manual review to ensure the accuracy of the overall decision.

It’s also important to note that the accuracy of the decision is highly dependent on the accuracy of the information entered in the system.

For instance, if credit report entered in the system is misleading or false, the decision will be misleading.

Further, the system does not eliminate the need for a human underwriter in the process of decision-making. However, their role is limited to reviewing the information to be entered into the decision- system.

LendSaaS requires fewer documents to reach approval decisions than manual evaluation. An automatic decision will help achieve higher business efficiency and improved customer experience.

2. Automated ACH Collection

Collection of funds is one of the greatest challenges an MCA business has to face. It’s expected to utilize a large portion of business resources and time. The reason seems to be simple and straightforward in terms of the business model of MCA.

The business is expected to collect funds from different borrowers with higher frequency. Likewise, there is a strong need to keep track of the amount owed. Hence, there is a need to establish a fast, convenient, and reliable collection and tracing mechanism.

The collection system comes with the capability to track amount owed, in a fast and secured way.

LendSaaS speeds up your collection speed and helps enhance the quality of record keeping. Likewise, timely receipt of the collection means cash flow problems are reduced.

ACH is connected with an external bank account and automatically collects payments according to the agreed scheme. Further, the cost associated with ACH is lower than traditional means of collection like paper checks.

So, Why Are Automated ACH Collections so Essential For An MCA Business?

- Cash flow position is improved with efficient and optimized payment collection systems.

- It’s an efficient system for collecting recurring payments and MCA is expected to collect funds from time to time.

- It’s a comprehensive payment solution for the customers and businesses as well.

- Enhanced accuracy of the collection leads to lower transactional and posting errors. Hence, the overall reliability of the function increases.

- The ratio of return payment decreases on account of higher back-end system integration. Further, balances can be tracked with higher efficiency.

- Implementation of ACH leads to higher reliability and more predictability for the financial forecast. Hence, the ability of a business to make financial decisions increases.

- ACH leads to the elimination of procedural formalities for manual payment processing. For instance, there is no need to manually handle checks, keep them safe and track them at the time of need.

- Borrower’s experience with MCA is enhanced with a reliable and easy-to-use payment method. Hence, enhanced customer loyalty is expected.

So, ACH seems to be a welcoming change from a business and customer perspective as well. Having an MCA platform in 2022 will make everyday processing easier for both you and your clients/partners.

3. Detailed reporting

MCA platforms provide a reliable and comprehensive reporting mechanism that helps business managers and owners to make informed financial and strategic decisions.

It’s about the presentation of financial information in such a way that it’s easy to read and interlink significant changes in the balance and come out with logical and plausible decisions based on the data provided.

Here are some of the qualities expected from MCA platforms with perspective to business reporting,

1. Intelligence and courage in terms of financial and operational activities

Platform-based reporting enables you to timely identify expected problems in the business. For instance, there might be an expected gap in available finance and demand from borrowers.

Hence, you can make efforts to arrange finance timely and ensure your terms with the borrowers are not compromised.

Likewise, this reporting system has the capability to forecast volume of operational activities. So, you can timely arrange the resources required to remain viable in business.

For instance, there may be an expected increase in borrowers demand for funds. Hence, timely arrangements can be made to tackle increased demand.

2. Appropriate structure, reliable knowledge, and professional presentation

Appropriate structure refers to the presentation of facts and figures appropriately. It’s about presenting the information in logical flow without compromising fact connection.

In addition to this, software generated reports are integrated with the operational systems. Hence, the information and facts presented in the report are backed by appropriate evidence leading to higher reliability.

3. Relevance and reliability

Relevancy refers to presenting information as desired by the user. For instance, MCA managers and business owners need to frequently analyze outstanding debtors, total balances owed, current capacity to approve loans, forecasted cash position, and maturity analysis etc.

Likewise, reliability is acquired by a disciplinary approach to record and manage operations backed by the automatic and reliable way.

Conclusion – Why Your Business Needs An MCA Platform In 2022

Implementing an MCA platform in 2022 WILL help to boost your business and related operational efficiency. It’s about adding strategic competence in business operations and transactions management.

There are numerous advantages of MCA platforms, including automated underwriting, automated ACH collection, and detailed reporting.

Automated underwriting refers to using artificial intelligence in making decisions for loan approval. It’s about analyzing different input aspects and deciding if a particular application for the MCA should be accepted.

Automated ACH collection is about optimizing funds collection from the borrowers. It helps enhance business capability for collecting cash in a fast, easy, reliable, and convenient way.

Detailed reporting is about presenting relevant facts and figures in an easy-to-use and professional format to aid in operational decision-making.

Schedule A Demo Today And See How Our Premier MCA Platform Will Grow Your Business In 2022

Schedule a 15-minute demo, we’ll show you what you have been missing out on.

Leave a Reply